Get the free irrevocable life insurance trust form

Show details

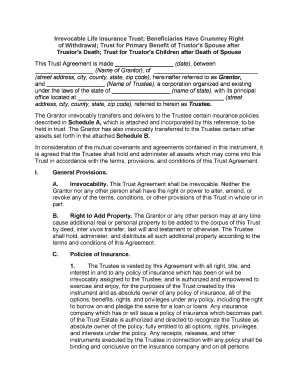

Sample Irrevocable Life Insurance Trust Forms And Other Related Items 17. 1 SAMPLE ILIT FORM1 Appendix 1 contains a sample form of irrevocable trust designed to hold life insurance on the life of one person who is married. This form is the sample ILIT that is referenced throughout this book. The trust is drafted on the assumption that the grantor alone will be making contributions to the trust. The sample form contains a contingent Marital Trust that is intended to qualify for the QTIP...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign understanding the irrevocable life insurance be changed by the grantor form

Edit your irrevocable life insurance trust sample form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irrevocable life insurance trust forms online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit life insurance trust form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out printable irrevocable trust form pdf

How to fill out irrevocable life insurance trust:

01

Gather all necessary documents such as the trust agreement, insurance policy, and beneficiary information.

02

Consult with an attorney specializing in trust and estate planning to ensure you understand the legal requirements and implications of establishing an irrevocable life insurance trust.

03

Identify the beneficiaries who will receive the proceeds from the life insurance policy held within the trust.

04

Name a trustee who will be responsible for managing the trust and ensuring that the insurance premiums are paid.

05

Complete the trust agreement, specifying the terms and conditions of the trust, including any specific instructions for the distribution of the life insurance proceeds.

06

Fund the trust by transferring ownership of the life insurance policy to the trust, making the trust the policy's beneficiary.

07

Notify your insurance company of the transfer and provide them with the necessary documentation.

08

Regularly review and update the trust as needed, especially if there are any changes in your beneficiaries or circumstances.

Who needs irrevocable life insurance trust:

01

Individuals who have substantial assets and are seeking to minimize estate taxes.

02

Those who have a high net worth and want to protect their assets from potential creditors or legal claims.

03

Parents or grandparents who want to leave a legacy for their children or grandchildren while minimizing estate tax liability.

04

Business owners who want to ensure the continuity of their business in the event of their death.

05

Individuals who want to maintain some control over the distribution of their life insurance proceeds beyond their death.

06

Couples who have a blended family and want to ensure that their assets and life insurance benefits go to their intended beneficiaries.

07

Individuals who want to provide for their loved ones with special needs, ensuring that they can receive the necessary care and support even after the insured person's death.

Fill

irrevocable trust forms pdf

: Try Risk Free

People Also Ask about irrevocable trust form

How do I put my life insurance into trust?

To put your life insurance into a trust, you'll need to create a trust deed; a legally binding document which outlines the parties that make up the trust, the trust terms, and the trust beneficiaries.

How much does it cost to set up a life insurance trust?

The price to establish a trust varies ing to your estates attorney's legal fees. However, expect to pay $1,600 to $2,000. Although setting up a trust is more expensive, it gives you more control over how the funds are spent and when your child gets access to the funds.

Is it worth putting life insurance in trust?

Putting your life insurance into trust is a popular option that comes with many perks. As we have mentioned, it could save your loved one from having to pay inheritance tax on the payout, but that's not the only benefit. In many ways, writing your life insurance policy in trust puts you in the driving seat.

How does a life insurance trust work?

An Insurance Trust is fairly straightforward to set up and operate. Once it's created, the Grantor funds it by putting their life insurance policy into it. This means that the Trust in essence now owns the policy (even though it still names the Grantor as the one who's insured).

What is a life insurance trust form?

It allows the owner of property (or in this case a life insurance policy) to transfer legal ownership of that policy to another person. The original owner of the life insurance policy is known as the settlor.

What is the disadvantage of a life insurance trust?

Life Insurance Beneficiaries Trusts are not considered individuals; therefore, life insurance proceeds paid to trusts are generally subjected to estate tax. Also, the proceeds payable to a trust may not qualify for the inheritance tax exemption provided by some states for insurance payable to a named beneficiary.

How does an insurance trust work?

How Does an Insurance Trust Work? An Insurance Trust is fairly straightforward to set up and operate. Once it's created, the Grantor funds it by putting their life insurance policy into it. This means that the Trust in essence now owns the policy (even though it still names the Grantor as the one who's insured).

What is the purpose of a life insurance trust?

An insurance trust can be an easy way to shelter the insurance proceeds from eventual estate taxes and prevent those proceeds from pushing your spouse's estate value over the estate tax exemption threshold.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete irrevocable life insurance trust on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your irrevocable trust form pdf, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I edit irrevocable life insurance trust template on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute the irrevocable life insurance trust ilit form is a key be changed by the grantor from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete printable irrevocable trust form on an Android device?

On an Android device, use the pdfFiller mobile app to finish your irrevocable life insurance trust example. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is irrevocable life insurance trust?

An irrevocable life insurance trust (ILIT) is a type of trust that holds a life insurance policy outside of the insured's estate, ensuring that the death benefits are not subject to estate taxes.

Who is required to file irrevocable life insurance trust?

Typically, the grantor (the person who creates the trust) and the trustee (the person or entity managing the trust) are involved in the establishment of an ILIT, but there is no formal filing requirement for the trust itself.

How to fill out irrevocable life insurance trust?

Filling out an ILIT involves drafting the trust document with specific terms, designating the trustee, naming beneficiaries, and specifying how the life insurance policy will be managed; it is advisable to consult an attorney for this process.

What is the purpose of irrevocable life insurance trust?

The purpose of an ILIT is to remove the life insurance policy from the taxable estate of the grantor, thereby reducing estate taxes and providing a means for beneficiaries to receive the death benefit free of income and estate tax.

What information must be reported on irrevocable life insurance trust?

Information typically reported includes the trust's name, the names of the grantor and trustee, the policy details (including policy number and insurer), and the beneficiaries designated to receive the death benefits.

Fill out your irrevocable life insurance trust online with pdfFiller!

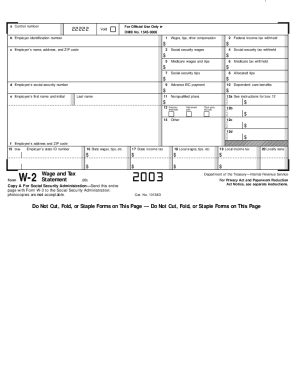

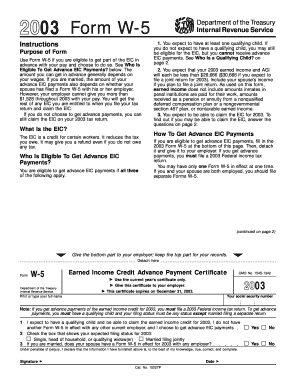

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trust Form For Life Insurance is not the form you're looking for?Search for another form here.

Keywords relevant to example of irrevocable trust

Related to ilit download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.